Hyperliquid: The High Performance Era

1 July 2024

0xOmnia, Co-Founder at Protecc Labs, June 27th, 2024

NFA and DYOR – Entertainment purposes only.

Table of Contents

High Level Overview

Hyperliquid Layer 1

Perpetuals

HLP

Spot Trading

In-Depth Primer on HIP-1 & HIP-2

$PURR

Memecoin Comps

EVM Compatibility

Capital Inflows

Ease of Use

Competitors

Decentralized Competitor: Solana

Centralized Competitor: Binance

All Roads Lead to Hyperliquid

Tooling: Team and Community Built

Point System

Hyperliquid Valuation Potential

Risks and Invalidation

Conclusion

High Level Overview

Hyperliquid is a custom-built, performance-optimized Layer 1 blockchain, developed by the team that previously ran Chameleon Trading, a former top 10 crypto HFT firm, which began in 2020 and was led by Jeff and Illiensic, who were Harvard classmates. Other team members are from Caltech and MIT, and previously worked at Airtable, Citadel, Hudson River Trading, and Nuro. The team expanded into DeFi in summer of 2022 and were greatly disappointed by the quality of products onchain as opposed to their centralized counterparts, such as Binance, ByBit, and Coinbase – inspiring the creation of Hyperliquid.

Arguably of the most defining factors of Hyperliquid, is that the team has taken on zero external capital, and according to Jeff in his most recent podcast with Blockworks’ 0xResearch, will not take any outside investment. This strategic decision allows the team to focus exclusively on building a product they believe in, without external pressures or influences.

The vision behind Hyperliquid is best explained by Founder, Jeff Yan, in his most recent tweet:

“What’s the point of all this? To build something that really matters. When finance moves onchain, it will bring trillions of dollars of value to billions of users. It won’t move for a half-baked system, but the Hyperliquid L1 has a shot. When you see a 100x, you drop everything to make that a reality. Factors of <2 are insignificant. Big things take time to build, but nothing else is worth building.”

This vision underscores Hyperliquid's ambitious goal: to create a blockchain infrastructure capable of supporting the future of on-chain finance, potentially revolutionizing the industry and bringing unprecedented value to users worldwide.

Hyperliquid Layer 1

The Hyperliquid L1 is performant enough to operate a seamless perpetuals DEX, with ambition to power an entire ecosystem of permissionless financial applications. The Hyperliquid L1 uses a custom consensus algorithm called HyperBFT which is heavily inspired by Hotstuff and its successors. Both the algorithm and networking stack are optimized from the ground up to support the L1. Some properties of HyperBFT, as described by Jeff:

1) Immense TPS Improvements

The current bottleneck for the Hyperliquid L1 is Tendermint, which caps out at 20k orders per second. HyperBFT can support up to 100x the throughput, though in practice the state machine execution will be a bottleneck at around 200k orders/second.

2) Non-Blocking Consensus

Unlike Ethereum and Tendermint, the consensus algorithm can continue sequencing transactions without waiting for the hash of the current block being executed. This non-blocking nature enchances overall efficiency.

3) Improved and Stable Confirmation Latency

Block times are bounded only by the network delay. Unlike earlier BFT algorithms such as Tendermint, there is no synchronous timescale baked into the consensus algorithm itself under normal block production. Blocks are produced as quickly as a quorum of validators can communicate. This property is sometimes called "optimistic responsiveness."

Perpetuals

Hyperliquid’s flagship application, it’s Perpetuals product has soared to immense heights, Key highlights include:

Consistently topping the derivatives charts by daily volume

Highest number of unique Daily Active Users (DAU) among on-chain perpetuals products

170,806 cumulative users as of June 26th, 2024

Stabilized at approximately 7,000 DAU

VIP Fee Tiers

Market Maker Fee Tiers

With an extremely attractive fee-structure for both retail traders and market makers, Hyperliquid’s perpetuals product has shined while most onchain perps products have bled users, mostly due to a lethal mixture of high-fees, clunky UX, lack of available trading pairs (as opposed to Hyperliquid’s 137 USD-denominated pairs currently), and the most dreaded reason of them all; airdrop farmers exiting after they have secured a bag.

This problem isn’t isolated to just onchain perpetual DEX's, it’s plagued a vast number of projects across the entire crypto ecosystem that lack a heavy-hitting, sticky product.

HLP

HLP, or “Hyperliquidity Provider” acts as the liquidity provider and liquidator for all 137 (current) Hyperliquid perpetuals markets. It democratizes market making and liquidations on Hyperliquid, by allowing anyone to deposit USDC into the vault, and being subject to a lock up of only 4 days. Here is a breakdown of its key features and performance:

Core Concepts:

Acts as a liquidity provider and liquidator for all Hyperliquid Perpetuals Markets

Allows anyone to participate by depositing USDC into the HLP Vault

Short lock-up period of 4 days

Community Ownership:

Entirely community-owned

Hyperliquid team takes zero profits from HLP

Performance Metrics:

Total Profits: $28,262,491 (as of writing)

Maximum drawdown since inception (May 2023): -5.58%

Yield Generation:

Peak Yields exceeding 100% APR at times

Typical monthly range: low ~20% APR

Most profitable during volatile market conditions

The Hyperliquid team approached showcasing their technologically advanced platform to the world by taking a vertical-first approach with its robust perpetuals DEX and fully onchain orderbook powering it, developing a cult-like community in the process. Having taken this approach allowed them to then expand horizontally into now creating a robust spot trading ecosystem, on their groundbreaking onchain orderbook.

Spot Trading

The introduction of HIP-1 and HIP-2 (Hyperliquid Improvement Proposal) changed the game entirely for Hyperliquid. These developments take Hyperliquid from a vertically-built, standalone appchain, to a grass-roots ecosystem looking to expand from its consistently dominant application prowess – in other words, the users came for the product, and stayed for the ecosystem.

In-Depth Primer on HIP-1 & HIP-2

HIP-1: Permissionless Token Deployment and Spot Order Books

Key Features:

Permissionless deployment of native tokens

Creation of on-chain spot order books

Flexible token distribution mechanisms

Benefits:

Allows users to create and list new tokens without centralized approval

Enables customizable token distribution strategies

Supports community-driven token ecosystems

Unique Capability:

Ability to include holders of other tokens in the genesis distribution of new tokens

Example: Airdrop token $B to holders of token $A

Distribution can be proportional to the holder base of the included token

Implications:

Fosters innovation in token creation and distribution

Enhances community engagement and cross-token synergies

Provides a powerful tool for project launches and ecosystem growth

Concept:

A novel mechanism inspired by Uniswap, designed to enhance liquidity in spot order books for HIP-1 tokens.

Key Features:

Permanent liquidity commitment to unique spot order books

Entirely on-chain liquidity strategies

Synergy with other market participants' liquidity

Performance:

Guarantees a 0.3% spread every 3 seconds

Advantages:

No maintenance required (similar to smart-contract based pools on general-purpose chains)

Participates in a general-purpose order book

Allows active liquidity providers to join alongside Hyperliquidity at any time

Improvements over Traditional Models:

Adaptability to increasing liquidity demand

Integration with standard order book systems

Enhanced market efficiency and depth

Operational Mechanism:

Runs entirely on-chain, ensuring transparency and reliability

Automatically adjusts to market conditions

Complements rather than competes with traditional market makers

Implications for the Ecosystem:

Improved liquidity across all listed tokens

Lower barriers to entry for new token projects

Enhanced trading experience with tighter spreads and deeper markets

These HIP’s represent a significant leap forward in DeFi. HIP-1 democratizes token creation and distribution, while HIP-2 ensures robust liquidity for these new markets. Together, they create something more dynamic, efficient, and user-friendly trading environment within the Hyperliquid ecosystem.

$PURR

$PURR was an interesting “gift” to Hyperliquid Points holders, meaning that if you had participated in Hyperliquid prior to the launch of $PURR, and accepted the new terms and conditions (via the UI), you received your pro-rata share based on your amount of points held. With no sale or utility, it has the makings of a real memecoin, while also serving as a worthy stress test of HIP-1, HIP-2, and the new spot markets.

Key Points:

Distributed to Hyperliquid Points holders who accepted new terms and conditions

Pro-rata distribution based on Points held

No initial sale or defined utility, embodying true memecoin characteristics

Supply and Distribution Details

Initial planned supply: 1 Billion Tokens

Adjusted Supply: 600 Million Tokens

Distribution:

500 Million (~83.33%) to Points holders

100 Million to HIP-2 for permanent orderbook spot liquidity

400 Million tokens (40% of initial supply) burned pre-launch

Tokenomics and Burning Mechanism

100% of maker and taker fees on $PURR trading are burned

Current burn: ~1,036, 000 $PURR (~0.166% of supply)

Burn address ranks as the 87th largest holder

All-time high market cap: ~$126,000,000

Track the Purr burn, holder list, and live comps to other memecoins here.

Pre-launch, there was an adjustment to the total supply based on user testnet feedback. The total supply for $PURR was slated to be 1 billion (split 50/50 between points holders and HIP-2, to be committed as permanent orderbook spot liquidity) – but pre-launch was reduced to 600m total – resulting in a split of 500m (~83.33% of new supply) going to points holders proportionally, with the remaining 100m to HIP-2, meaning a burn of 400m tokens (40% of total supply).

In addition to this, 100% of maker and taker fees on $PURR trading are burned, resulting in ~1,036,000 $PURR (~0.166% of supply) burned through trading fees currently making the burn address the 87th largest holder, while having only hit an all time high of ~$126,000,000 market capitalization. Track the Purr burn, holder list, and live comps to other memecoins here.

Memecoin Comps

Note: Holder count does not factor in exchange holds, only cumulative onchain holders across all chains each token is deployed on.

With the introduction of a “L1 Season” by Hyperliquid and slated to end in late September (as opposed to the end of Points in May after an 8 month run), the immediate response was panic and frustration. For those with the patience to read between the lines, it was the buying opportunity they had wished for throughout the entire month since $PURR had launched – it essentially meant that $PURR is the only way to speculate on Hyperliquid growth until the launch of Hyperliquid’s native token, which will only be used to validate the network, as the native L1 will always remain gasless, it’s that performant.

You may be asking now: “Then what value does $PURR have after Hyperliquid’s token is released?”

To that I’d say:

It’s the equivalent of wondering what kind of value $PEPE / $MOG have while $ETH exists, or why $BONK / $WIF, which have traded up to between 4% - 10% of $SOL value. $PURR is the Hyperliquid mascot, it’s beta to the growth of Hyperliquid after the native token launches, and will likely continue to yield continuous distributions from other native tokens that launch on the Hyperliquid L1 – which has been a crucial part of GTM for many of the native tokens currently trading. $PURR’s usage as sound collateral throughout Hyperliquid DeFi given its wide distribution and deep liquidity will prove to be yet another upcoming usecase.

EVM Compatibility

So we’ve touched on many of the feats that Hyperliquid has accomplished since its inception, but the introduction of EVM Compatibility reduces the friction needed for the floodgates of capital inflows to open for Hyperliquid by 100x.

“The EVM will be augmented to atomically compose with native components on the Hyperliquid L1: HIP-1 assets, spot trading, perp trading, and other DeFi primitives.

Today, Hyperliquid already offers massively scalable throughput for the most heavily used defi operations. The EVM will unlock the full breadth of applications that do not require heavy optimization, such as bridging, auctions, lending, and novel user applications.

The EVM is not an isolated feature, but rather an integrated approach toward scaling the L1. By routing the highest throughput transactions through performant native components, the long tail of applications can enjoy ample blockspace. By empowering users to build on the EVM, the native order books will benefit from trustless bridging, new assets, and improved liquidity.

As one example of EVM composability with native components, HIP-1 assets will feature an atomic transfer with their corresponding ERC-20 contracts. This interaction will enable Hyperliquid L1 to become the premier platform to build, launch, and trade tokens. Builders will be able to deploy smart contracts with familiar EVM tooling and connect instantly to the CEX-like trading experience that users love. As the Hyperliquid L1 matures, users will no longer need centralized exchanges or other blockchains.”

TLDR; this will allow for the development of a suite of applications such as DEX frontends (simply using the high-performance native Hyperliquid components), CDPs, money markets, scalable SocialFi, and much more – becoming more akin to a CEX, built completely onchain, rather than a standalone DeFi appchain and corresponding ecosystem. The EVM effectively acts as a native sidecar, as opposed to yet another destination to bridge to.

Capital Inflows

According to Impossible Finance’s Dune Dashboard, there have been capital inflows of ~$26.947b to a range (not all) of EVM compatible L2’s since July of 2023. Most of this capital has largely been deployed to farm L2’s native token airdrops by loosely interacting with dApps, most of the stickiness being completely lost after the announcement and subsequent airdrop of the native token, resulting in L2 DAO’s getting caught up in the wake up airdrop farming, and scrambling to rollout sticky incentive programs that only further decay whatever still exists of an ecosystems audience after the token is released.

In short, ecosystems have gotten impressively good at self-cannibalism.

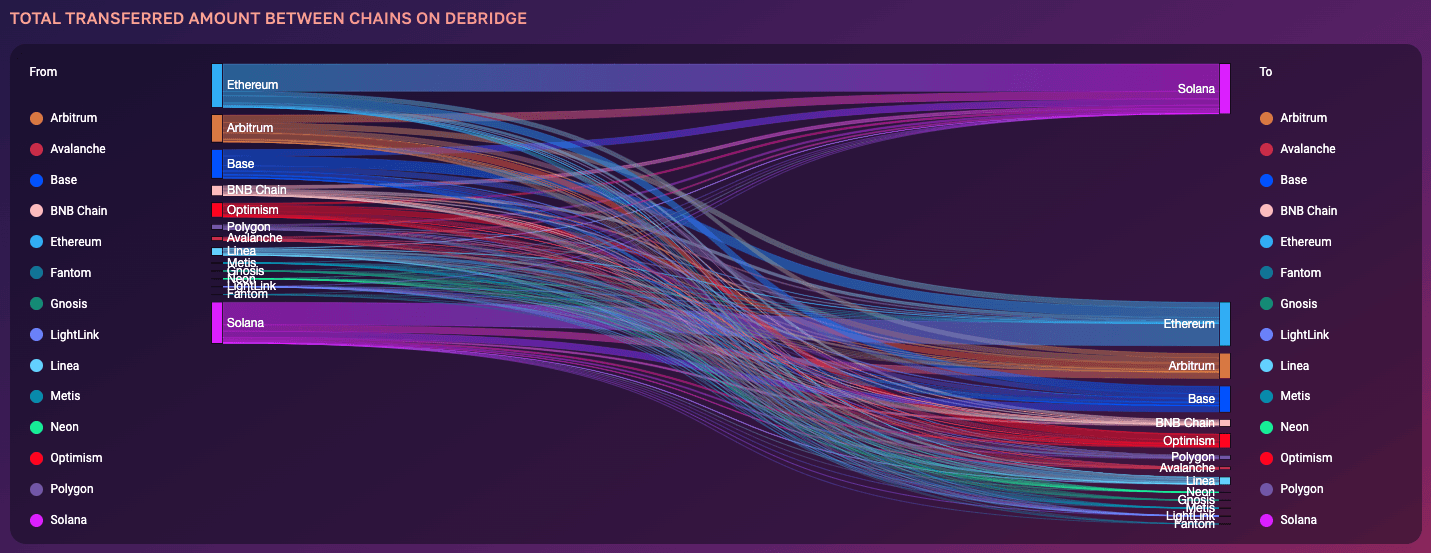

Just taking DeBridge for example, 76.97% of their cumulative bridging volume has been between EVM-compatible L2s, with the remaining volume going through Solana (the only other performance-built chain aside from Hyperliquid).

Ease of Use

Currently, if a user wants to track their portfolio on Hyperliquid, one needs to access the website and view their portfolio and its breakdown from there. However, in an increasingly simplified world of portfolio management software, most power users resort to tracking their positions whether idle, yield generating, staked, vesting, locked, etc through portfolio management applications such as Zapper or DeBank – the introduction of the Hyperliquid EVM makes it possible to finally integrate Hyperliquid as part of their offerings, given the valued locked on Hyperliquid (cumulatively between perps and spot) now sitting just shy of $500m, making it the 15th largest chain by value locked per DefiLlama, which is only pre-EVM compatibility.

DeBank for example, supports 105 chains and counting – it’s extremely difficult to imagine them not supporting Hyperliquid EVM once mainnet is reached.

This simple, yet extremely effective addition to the available Hyperliquid tooling that users can enjoy when they bridge into the chain, makes it increasingly likely that we see a large influx of capital move into Hyperliquid within the first 90 to 180 days after EVM mainnet is live, and testnet has already been reached, a mere couple of weeks after announcing it.

Competitors

Many have attempted to argue that Hyperliquid’s primary competition are simply other Perpetuals DEX’s, and this couldn’t be further from the truth. While Jeff mentioned on the most recent 0xResearch podcast (linked above) that they do not believe there are any competitors to Hyperliquid – I believe that it’s important to realize what domains Hyperliquid is looking to disrupt, and below I’ll lay out the 2 competitors in their respective arenas, who’s lunch Hyperliquid is coming for.

Decentralized Competitor: Solana

Founded in 2020, and according to Kevin Bowers, Chief Science Officer and Head of Research and Development at Jump Trading, Solana is the only blockchain in existence (aside from Hyperliquid) that is built for performance, having mentioned this here while speaking with Solana about the Firedancer client that is being developed by Jump. Solana has been all the rage over the last 8-10 months, particularly due to the ridiculously friendly conditions for memecoin trading such as high speed, low-cost transactions.

Centralized Competitor: Binance

Binance on the other hand is another animal entirely. Founded in 2017 by the legendary CZ (now imprisoned for 3 more months in a US Federal Penitentiary), and has since become the largest crypto exchange in existence, with >200m users – most popular for its liquidity for spot and perps trading, massive amount of token listings, and transparency with its Proof of Reserves, proving a minimum of 1:1 asset backing.

All Roads Lead to Hyperliquid

It is safe to assume that most, if not all market participants can agree that both Solana and Binance have become behemoths in their respective domains, and offer extremely favorable environments for each of their target audiences. Hyperliquid solves what has largely been a massive issue on Solana, onchain orderbooks and fragmented liquidity, the need for SOL as gas to transact.. while simultaneously solving what has largely been a massive issue for Binance, decentralization (no need for stringent KYC/AML to access best-in-class products).. which saw Binance introduce Binance Smart Chain, powered by their native token, BNB, and since then has unfortunately been plagued with tons of scams and a variety of incompetent DeFi protocols (bar a few trendsetters and successes from the last bull cycle in 2020-2021).

Simply imagine what it would be like if you were to ask anyone from the prior bull-cycles what it would be like to trade on an extremely high performance, decentralized version of Binance, what would be the response? I’d be willing to bet that at minimum, 9/10 would be doing whatever humanly possible to get involved earlier, if it was only even half true.. and the remaining 1/10 would likely think of this as an impossibility, meanwhile, it’s in existence today, and iterating in prod – in the form of Hyperliquid.

Tooling: Team and Community Built

The Hyperliquid team and community have built phenomenal tools, allowing traders to have nothing shy of the best possible onchain trading experience. Below, I’ll list out what some of these tools are:

Funding Rate Comparison (Team)

API (Team)

Statistics (Team)

Testnet (Team)

Explorer (Team) – P.S. Community version is elite, under “Scanner” below.

Documentation (Team)

Funding Rate Heatmap (Community)

Scanner (Community)

PURR Burn Tracker and Leaderboard (Community)

Position Tracking (Community)

Copy Trading (Community)

Spot Token Trading Bot and Sniper via Telegram (Community)

Hyperliquid Points

The Hyperliquid Points program has been kept extremely secretive by the team, understandably so. In a hyper-extractive environment where the “rules to the game” so to speak have been made not only extremely public, but meant to farm farmers, this approach has been refreshing – truly caring about who ends up owning the network has already begun paying off massively, and will continue to do so, as the cult-like community of Hyperliquid only strengthens.

The Points program has been split up into 4 phases (2 of which, unknowingly to the community), where users of mainnet Alpha, users through Perps Phase, users in May 2024, and users through L1 Phase have all received points. Note, L1 Phase, perceived to be the final opportunity to receive points, runs until the end of September 2024.

Source: Washparkcrypto

Hyperliquid Valuation Potential

There is one thing that makes Hyperliquid stand out above any and all other Layer 1 blockchains (apart from its technology), excluding Bitcoin – which is its absence of VC / insider funding. Highlighted by Jeff on the most recent 0xResearch podcast, the Hyperliquid team takes inspiration from Bitcoin, and would like the network to most closely resemble it, which would allow the network to be free from the entanglement of early insider supply overhang, freeing Hyperliquid from the shackles of insider unlocks that even some of the largest tokens (excl. $BTC) struggle with.

For example, it was recently discovered that CZ, formerly of Binance holds >64% of the total $BNB supply per a Forbes report, more akin to the distribution of a shitcoin than the worlds largest exchange token, and a multi-month long OTC auction of FTX Estate’s $SOL holdings (at massive discounts as low as 65% off of market valuation) will see the rotation of claims on this vested $SOL potentially change hands constantly – in short, creating long winded supply overhang. Are these deal breakers for theses around each asset? Not at all, it’s just pressure that otherwise wouldn’t exist without the private venture markets participation in the first place.

To be fair, even Bitcoin goes through its own fair share of supply overhang issues, but to be clear and distinguish the differences, with Bitcoin it’s been caused only by seizures from criminals, and exchange hacks, such as Mt. Gox’s liquidations, who’s creditors will finally be getting paid back ($BTC and $BCH).

Typically, there are so many weird factors that play into a tokens valuation (whether at launch or over time) such as, but not limited to:

Amount released on TGE (Token Generation Event)

Team vesting and eventual unlocks

Investor vesting and eventual unlocks

Who is the token market maker

What exchanges will list the token

Hyperliquid’s eventual token launch will likely be one of the fairest launches to ever hit the market, due to the way that the team has carefully distributed points, which recently resulted in the $PURR airdrop, and will eventually result in the native token airdrop.

We believe that at minimum, 50% of Hyperliquid’s total supply will be distributed amongst Points holders, as they are the core users of the platform over the 18 months that the Points program will exist. We won’t speculate on the exact remaining token distribution at this time, but we do expect an extremely fair distribution of the remaining 50% of the native token supply given the fact that there will be no insider token allocations.

Note: Satoshi Nakamoto only holds 1,000,000 Bitcoin, out of the 21,000,000 that will ever exist, resulting in ownership of 4.76%.

Most Conservative $ per Point Estimate by End of 2024 (once converted to $HYPE): $50 – Implying a Fully Diluted Valuation of ~$5.10 billion.

Most Aggressive $ per Point Estimate by End of 2025 (once converted to $HYPE): $750 – Implying a Fully Diluted Valuation of ~$76.59 billion.

Whales Market (a popular place lately to trade pre-market tokens), has seen Hyperliquid points as low as $2.65/Point, with a grand total of 6,119 Hyperliquid Points listed (from $2.65/Point to $18/Point), representing a mere ~0.011% of total Points – proving how thin and unreliable as an indicator it is with regard to Hyperliquid. It requires users to post 1:1 collateral for their ask, and is conducted on a basis of trust, creating potential settlement risk once Points do convert to the native token.

Risks and Invalidation

As with everything, there is significant risk in this trade. To prove how risky it is, we don’t need to look very far back. A mere leak of Alameda Research’s balance sheet took down a once >$32b company. FUD about Binance’s (along with many others such as OKX, KuCoin, and ByBit) Proof of Reserves had many market participants in shambles scrambling to move funds off of exchanges, either completely offramping from the crypto market or fleeing to onchain stablecoins (mostly the former, as stablecoin outflows were massive), and this only scratches the surface of risks with Centralized Exchanges.

Onchain, Solana wasn’t having much luck either as there were an incredible amount of network outages that saw many deem the chain unusable for many periods of time, repelling teams looking to build on Solana, seeing them flee to Ethereum L2’s as a way to guarantee users cheaper transactions, faster speeds than Ethereum mainnet, and of course, token incentives to stir up more usage. Solana underwent so much FUD that even the most notable NFT collection on the chain, DeGods, fled the seemingly underwater sentiment of the ecosystem, bridging to Polygon, then Ethereum mainnet shortly after.

Primary Risks with Hyperliquid include, but aren’t limited to:

Smart Contract Risk (whitehat / blackhat exploiter) resulting in partial or complete loss of funds – or lack of trust from users. The scale of the insurance fund is unknown.

Execution Risk (inability to deliver on such massive promises) resulting in a subpar product.

Competition (alternative layer 1 blockchains) outcompeting Hyperliquid, resulting in stunting Hyperliquid’s growth.

If any of these were to occur, it doesn’t necessarily mean the death of the product, on the contrary, there have been many risks to the livelihood of other layer 1 blockchains, most notably Ethereum’s DAO Hack due to codebase vulnerabilities, yet, has strived to become the 2nd largest crypto asset by market capitalization.

Conclusion

Hyperliquid has a long road ahead of itself, even after being around 2 years in development, it is just beginning to show its hand to the market. While many of the biggest names in scaling solutions for Ethereum like StarkNet or zkSync have struggled to develop massive cult-like communities outside of airdrop farmers and toxic bagholders, Solana has eaten their lunch, stealing mindshare since they’re vehemently delivering on what users ultimately want: A better place to transact onchain. However, as important as it is to focus on what is hot and popular now, we must also look to the future, and stay ahead of the puck – demanding more skill than pure dumb luck, and although only time will tell if we are wrong, we believe that in the future, Hyperliquid plays a pivotal role in not just onchain trading, but all types of onchain experiences.

Source: L2Beat

There are >30 live and usable Ethereum L2s with even more under development, not counting a number of L3s that are building atop rollup scaling solutions. Where does this ever end for Ethereum? Will there be L4s next? L10s eventually? It’s a bit difficult to imagine a world where you need to keep bridging to the next chain, and the next chain, and so far, just to get a further “Layer” deeper. Even Solana has L2s in development, even when the Firedancer client is expected to allow for up to 1m TPS (transactions per second) over time.

The fastest L2 today is pushing ~103 TPS, with Ethereum mainnet at ~14.4 TPS, while Solana is at ~3,319 TPS today (all of these numbers fluctuate).

It is of the utmost importance to realize that Hyperliquid, in its infancy, is already running a network handling billions of dollars in trading volume at 100,000 TPS. What will it look like tomorrow?

Source: Solana Beach

In order for Hyperliquid to become a true CEX-killer and vertically integrated ecosystem, it would need fiat on-ramps in absence of need for multi-hop bridging, a robust lending market, deeper perpetuals liquidity across many more pairs, perhaps a Uniswap-style swap front-end to avoid potential orderbook complication for onchain traders and much more – but it’s well on its way to making these things happen, and beyond.

None of the information you’ve just read should be considered as financial advice, Protecc Labs and I have bags, fairly acquired on the open market. We’re publishing this out of our firm's growing excitement around Hyperliquid developments and growth. It’s imperative that you do your own research, only public information is used in this report, as it’s one of the most respected attributes of the Hyperliquid team – no matter your standing, market significance, or celebrity status, they couldn’t care less about giving away private information.

Study Hyperliquid.